Contents

The best Bollinger Band strategy with Japanese candlestick techniques is to look for the reversal pattern to reach the UBB or the LBB lines. You should ignore all other reversal patterns that are not touching the two volatility lines. Presidential election and the Trump effect is nothing but another opportunity that shows how to read Bollinger Bands indicator. Therefore, it is no wonder that over 90% of the time price is spending between the Bollinger bands. As a definition, a breakout is when a candlestick closes above the UBB or below the LBB lines.

Whereas in a Bollinger Bands squeeze, the market doesn’t swing up and down because the price action gets really tight and the candles are overlapping one another. So it’s impossible to identify support and resistance in a Bollinger Bands squeeze. The three lines mentioned above form a channel or band type structure which envelopes price action. These three lines act as dynamic support and resistance lines where price could either bounce from or breakout of. However, any forex strategy is only as good as the trader who is using it.

These momentum signals should also come after a prior market contraction phase, which could also be identified based on the contraction and expansion of the Bollinger Bands. The traditional MACD is an oscillator type of indicator which computes for the difference between two moving average lines. Then, a signal line which is derived from the MACD line is then plotted trailing the MACD line. We wouldn’t want to blindly take every reversal signal as the market could be trending which might see use get stopped out over and over again.

- There are basically two steps needed to be done before entering a trade.

- Crossovers of the two lines occurring when prices are either overbought or oversold tend to be very effective.

- When the traders expect earn money then they buy low signal and sell the high signals.

- Although these trading strategies have glaring differences, there are also many trade setups and scenarios wherein these different strategies could overlap.

The Bollinger band middle line can be used to place the stop loss and exit a position when the market turns around. One of these limitations is that Bollinger Bands are primarily reactive, not predictive. The bands will react to changes in price movements, either uptrends or downtrends, but will not predict prices. In other words, like most technical indicators, Bollinger Bands are a lagging indicator. Active traders may require a smaller number of periods and a smaller number of STD deviations. The price generally ranges between the upper and lower extremes.

Forex Bollinger Bands Strategy Introduction

I am a beginner and assure you, I will master this strategy. I was using volatility bands but without this unique knowledge and usually l was about to fade out. Very quick and easy way to understand how to use Bollinger Band for trading…..

If you want to have a higher probability of success with the Bollinger Band strategy, then you’ll need a few confluence factors coming together before you trade the bands. Because in trending markets, the market can remain “cheap” or “expensive” for a long period of time. At the close of the chart candlestick, you can execute a buy market order or place a buy stop pending order one pip above the high of the candlestick.

If you approve, the Triple B PRO system will prepare you for the trade. You don’t have to wait for the market to create conditions. Triple B PRO will alert you as soon as the conditions are met. You can receive MT4 alerts, and notifications via email or mobile phone.

Here, the middle line, i.e., moving average, indicates long-term price change. On the other hand, lower and upper lines create a space where price fluctuates. For calculating Bollinger Bands, you need to figure out the moving average of 20 days. The closing prices for the first 20 days are the first data point.

Bollinger Bands represents data by drawing three lines after analyzing, aggregating, and calculating the past records. Based on this article, volatility is best measured with the Bollinger Bands indicator. The key to staying profitable is to quickly reverse a position when a fake breakout occurs. A Bollinger Band scalping strategy applies easily, and you can trade the whole move until its end. The Bollinger Bands bandwidth acts both as a reversal pattern, when fake breakouts appear, as well as a continuation pattern.

Forex Trading Strategies Installation Instructions

Six periods later, EUR / USD breaks above the 20-period simple moving average Bollinger band. On the way up, we see several reversal candlestick patterns. However, they are not confirmed, and we do not consider them as a possible exit point for the transaction. At the end of the price rally, we see a Doji reversal candle followed by two larger bearish candles. The second bearish candle’s close can be seen as the first exit of the trade . If you decide that this signal is not convincing enough, you can expect the 20-period SMA breakout, which occurs three periods later.

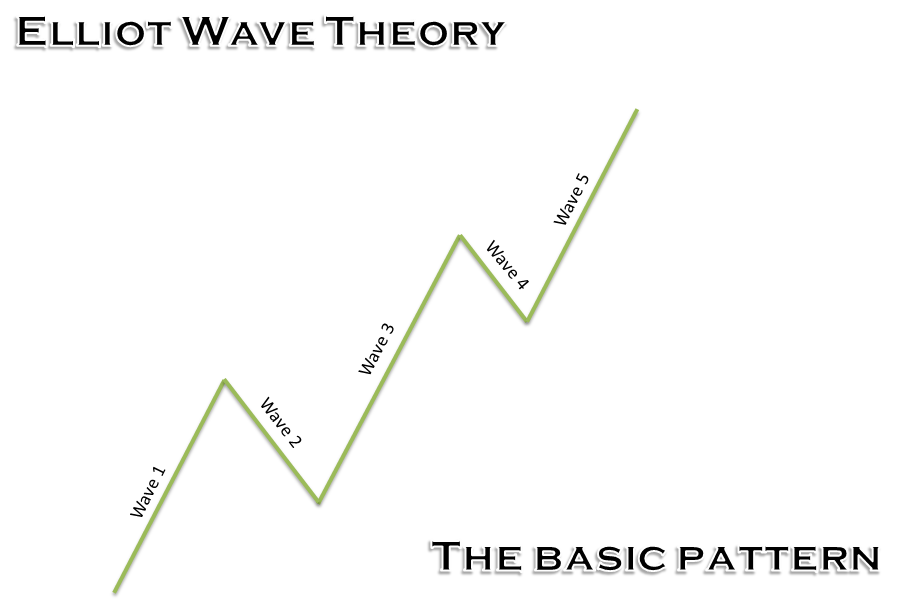

Another great way to use Bollinger Bands is to integrate the indicator with the Elliott Waves theory. This is one of the most popular trading theories that exists. It is well-known for the fact that it is incorporating human behavior/nature in the analysis.

The Bollinger Bands and RSI Combo (a little-known technique)

Complementary systems have been developed to help work hand in hand with this band especially when the trend isn’t very clear or rather ranging. The sum represents the value of the periods involved; they could vary depending on the times. If the values turn out to be 10, then we must https://1investing.in/ add up the values together to find the total sum. The higher the volatility in the market, the wider the Bollinger Bands, and the less the volatility in the market, the narrower the Bollinger Bands are expected. The lower bands can be interpreted as being low or inexpensive.

Another new feature we’ve added to the PRO version is built-in Pivot levels. Pivot levels help traders determine the best trading levels for a day or week The Two-Hour-A-Day Trading Plan based on purely mathematical calculations based on price action. Our indicator allows you to test all indicators from our user-friendly trading panel.

Sir can you elaborate RSI divergence cant understand well…. Your post and videos have turned a novice trader into a more skillful one. I’ve never used this indicator before and after following Mr Bollinger on twitter for a while now, I’m more interested to consider his indicator in my charts. That’s why you must also take into consideration Bollinger Bands, Support Resistance, and Candlestick patterns. And what you’re looking for is a divergence on the RSI indicator.

Price Action Candlestick Pattern Indicator for MT4 free

The Bollinger bands or trading bands act as a tool to measure risk and may involve statistical analysis based on Simple Moving Average or SMA. The upper and lower band are set at a distance of two standard deviations, above and below the simple 20 day moving average. The price is mostly held within the Upper band SMA and Lower band SMA . Volatility is measured using standard deviation, which changes with increases or decreases in volatility. By default, the upper and lower bands are set two standard deviations above and below the moving average.

The Bollinger Bands have already been considered in understanding the trend and changing patterns in trading, so their use for confirmation of price action is not recommended. And the indicator used should not be directly related to one another. For example, the one momentum or one-volume indicator successfully, but two-momentum indicators aren’t better than one. The same trading strategy is applied for trading any asset. If a trader expects the price of a currency to go up, they will buy the currency.

On the other hand, trend reversal traders often take trades as the market reverses. Some trade based on indicators such moving average crossovers, while others trade on trend reversal price action. They often do not get it right but when they do, they win big.

Select the default 20 SMA but this time use the setting with only one standard deviation. Don’t be afraid to skip the warning, two features will help you stay informed! If you missed an alert for any reason, but still wish to trade it when you are free and as long as market conditions permit, you can re-trigger the last alert issued by the system.